Picture the benefits of managing personalized portfolios at scale through a tech-forward platform—not only for your clients, but for your business as well.

Financial advisors are under more and more pressure to create unique, tax-efficient portfolios that stand out in today’s unstable markets. Investors, on the other hand, want solutions that fit with their values and goals, and generic strategies aren’t as valued as they used to be. Direct indexing is a new way of managing wealth that’s quickly gaining popularity. But what makes it so effective and sought after?

For decades, advisors have used mutual funds and ETFs to get a broad view of the market. These tools work and have their place in certain portfolios, but they aren’t known for precision.

They can keep unwanted assets locked up, cause extra capital gains taxes, and make it more difficult to customize investment strategies. Given how different ESG preferences and risk tolerances are from client to client, generic funds often miss the mark, which can lead to dissatisfaction. Every minute an advisor spends explaining additional fees, lower after-tax returns, or why an underperforming asset is being held indirectly is time taken out of their day to be growing their business or being productive for existing clients.

This lack of efficiency isn’t just a drag on the overall advisor-client experience; it’s also expensive if taxable gains aren’t managed properly. Over the course of decades, that can add up to tens—if not hundreds—of thousands of dollars in lost funds. Advisors risk losing clients to competitors who offer more personalized options, while investors may become complacent with less-than-ideal outcomes.

Direct indexing is a different way of managing investments altogether. You don’t buy a fund; instead, you own the underlying stocks that make up an index, like the S&P 500, directly in a client’s account. This facilitates precise customization and tax optimization that traditional methods aren’t as capable of.

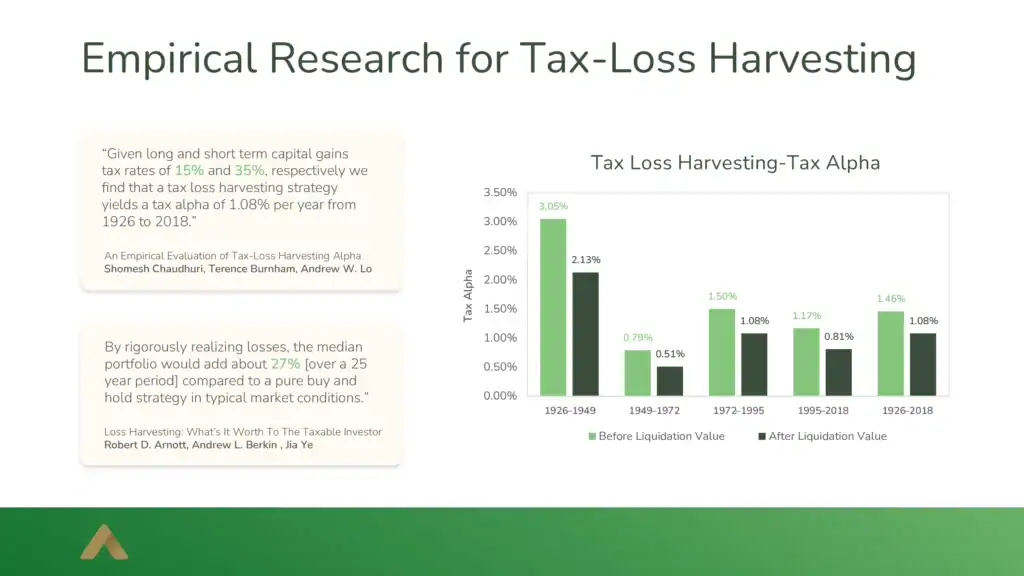

Tax-loss harvesting, for instance, is just one of the tangible benefits. With direct indexing, advisors can sell losing positions throughout the year to make up for gains in other areas. Alternatively, you could carry unused losses forward to offset future gains and income tax. That translates to earned loyalty, and assuming your business operates under a management fee model to generate revenue, your clients’ success becomes your own.

Claim 1 is from 2020, source: Chaudhuri et al., (2020). An Empirical Evaluation of Tax-Loss-Harvesting Alpha. Financial Analysts Journal, 76(3), 99–108. ALSO, the updated source claims 1.10%, not 1.08%

Claim 2 is from 2001, source: Arnott et al., (2001). Loss harvesting. The Journal of Wealth Management, 3(4), 10–18.

Next, there’s making it personal. Certain investors may want to keep tobacco stocks out of their holdings if you’re an ethical investor, while others believe in the future of tech stocks for long-term growth. Direct indexing makes it easy to pick and choose based on personal preferences while also keeping a close eye on the benchmark at the same time to measure overall portfolio drift. It’s like having a custom-made suit instead of one that you buy off the rack—they’re both wearable, but one fits and looks better.

For advisors, the benefits also apply to your practice. By standing out in a crowded market with highly personalized, transparent, and tax-efficient services, you offer real value that traditional index investing may fall short on.

Fulcrum Direct Indexing has intuitive, innovative, and automated tools that do most of the work for you:

By streamlining the overall process and helping you deliver these results at scale, you can reclaim the time to both grow your business and make sure your existing clients receive the care and attention to detail they’ve come to know you for. Ideally, clients will come to see you as more than just someone who picks funds—they see you as a strategic partner, which leads to stronger relationships and potentially more referrals.

We recognize the best advisor-client relationships work under a shared success framework. Investors also stand to gain: they can reduce fund expense ratios, potentially realize better after-tax returns, and have their portfolios reflect what they care about.

If you’re looking to realize those same benefits, we’re here to help, starting with a free consultation to see how you can drive the results you—and your clients—deserve.

Fulcrum Equity Management, LLC, doing business as Fulcrum Wealth Management Management, is an investment adviser registered with the SEC. Fulcrum Wealth Management only conducts business in jurisdictions where it is properly notice filed, or is exempted from such filing requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability.

Content should not be viewed as personalized investment advice. All investments and strategies have the potential for profit or loss. Index performance does not represent results obtained by Fulcrum Wealth Management and does not reflect the impact that advisory fees and other expenses will have on the returns. There are no assurances that an investor’s portfolio will match or exceed any particular benchmark. Alternative investments are speculative, may be susceptible to fraud, involve a high level of risk, and may experience significant price volatility. You could lose all or a substantial part of your money, and your interest may be illiquid. They may involve complex tax structures and higher fees.