Losses happen. In fact, U.S. markets have seen negative returns in roughly 1 out of every 4 calendar years over the past century. But not all red ink is wasted—especially for investors with taxable accounts—thanks to tax-loss harvesting strategies (TLH).

Investors can repurpose those losses as tax savings by closely monitoring their portfolio positions, allowing them to retain a larger portion of their earnings over time. This can be tedious, leading to lost time or missed harvesting chances, but Fulcrum’s technology-enabled integrations streamline the process, systematically tracking underperforming assets quietly in the background so every opportunity gets a fair look—all without your advisor taking their eyes off you and your goals.

At its core, selling securities at a loss in taxable accounts can be “harvested” to counter realized capital gains, reducing your overall investment income and tax bill when it comes due. Per the IRS, you can use up to $3,000 in net capital losses (when capital losses exceed capital gains) annually to further offset ordinary income tax, with the possibility of carrying excess losses forward indefinitely.

Academic research from MIT estimates that disciplined TLH creates annual after-tax benefits—often referred to as tax alpha—of 0.85% to 1.10% for diversified equity portfolios managed using direct indexing. A Vanguard study found a wider dispersion of outcomes over their 20-year study, noting that a hypothetical portfolio employing systematic TLH could capture 0.47% to 1.27% in tax alpha. These aren’t guaranteed, but they highlight what’s possible when the details are managed well, savings are reinvested, and stock losses are used to offset capital gains tax.

Vanguard’s findings suggest that tax-loss harvesting is most valuable for investors in higher marginal tax brackets, with meaningful taxable accounts and realized or anticipated gains. TLH is less impactful for investors without much turnover, those in low brackets, or those investing exclusively in retirement accounts.

It’s also worth noting that the three basic components of a successful TLH strategy are loss generation, conversion to tax savings, and market conditions. Some of these features are specific to the investor, many can be influenced, and others are beyond their control:

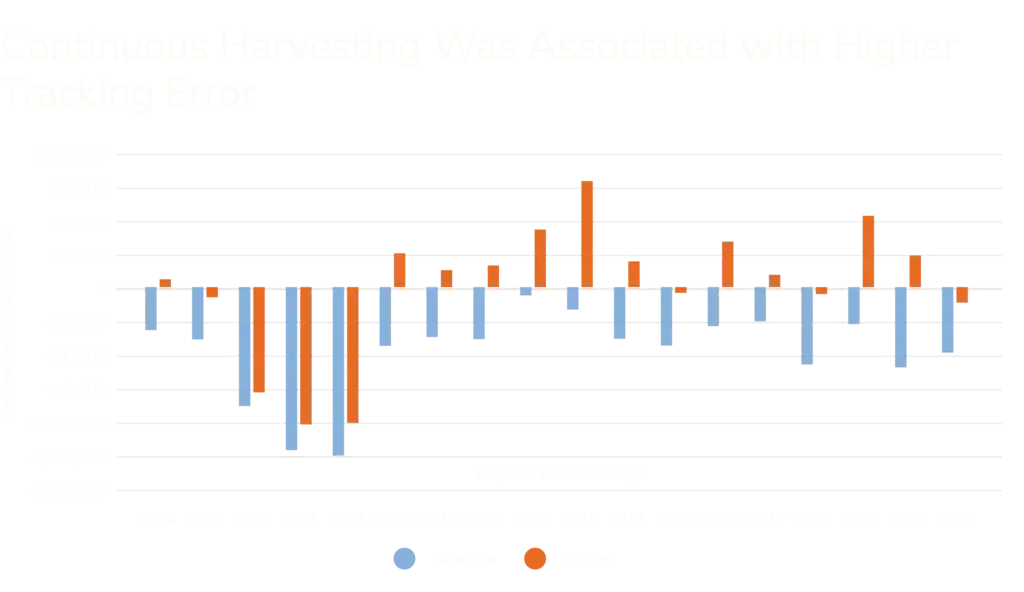

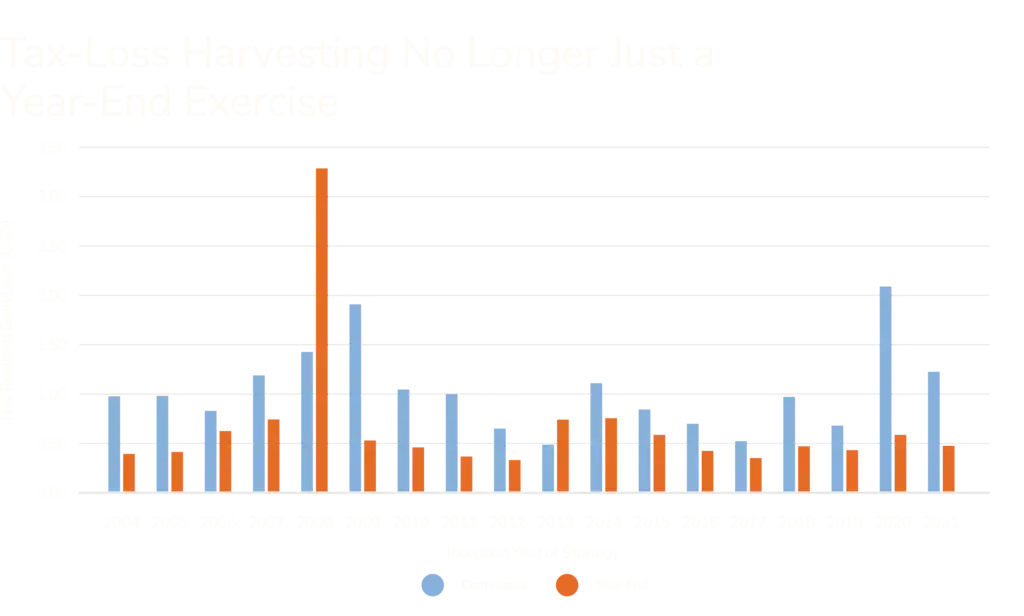

Investors often wait for year-end to begin tax-loss harvesting, but data from MSCI shows that ongoing, technology-aided monitoring—monthly or daily—can capture more harvestable losses over a market cycle compared to annual-only checks.

However, this approach also encounters increased tracking errors as portfolios deviate from their benchmarks. When using a continuous TLH approach, it’s important for investors and their advisors to carefully weigh a higher rate of tracking errors against potential tax benefits.

Thankfully, Fulcrum’s platform keeps watch year-round, working at the tax-lot level, and suggests suitable replacements to keep your investment profile stable when rebalancing or loss harvesting to offset gains.

Of particular interest in this strategy is that research has identified a potential “sweet spot” here. When monitoring opportunities daily, it’s recommended to wait for the security to fall by -15% before selling and -10% for monthly harvesting.

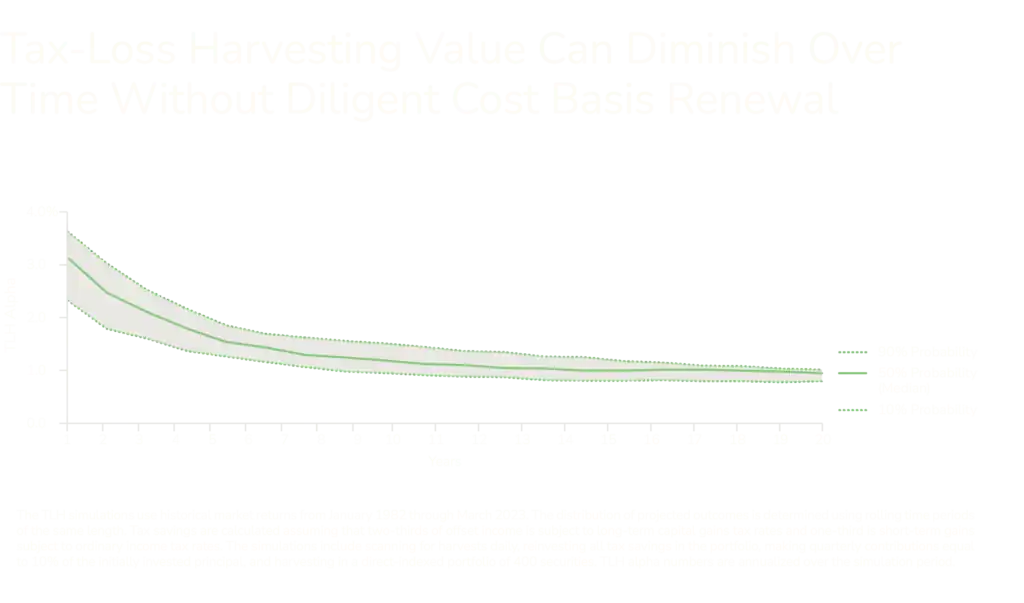

Harvesting losses can lower cost bases, which means that higher taxes may apply if assets appreciate and are sold later. TLH can defer—not eliminate—tax obligations. By pushing down the overall cost basis of the portfolio, and given the long-term trend of markets generally appreciating over time, reinvested proceeds become harder to harvest down the line. These factors can cause tax alpha to slowly deteriorate. Loss-harvesting benefits are typically front-loaded.

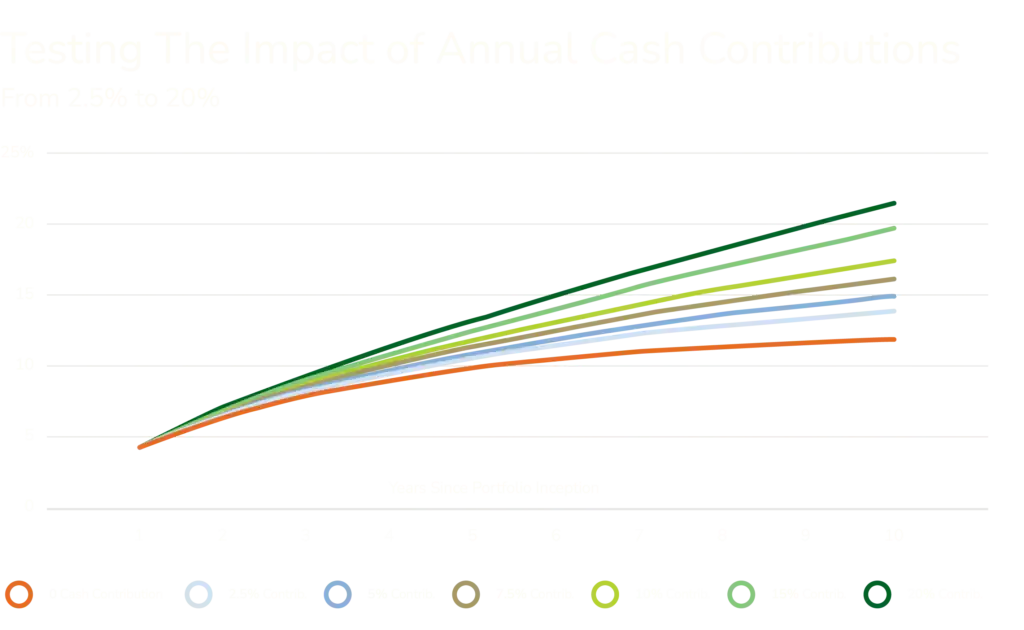

Not every dollar is created—or invested—equal. For investors hoping to preserve the effective shelf life of TLH strategies, tax savings, dividend distributions, and capital external to your existing portfolio can be used to purchase securities. By doing this, investors can create new tax lots with higher cost bases, counteracting the tax alpha decay of strictly reinvesting.

We’ll take a moment to clarify the technicalities of what’s called portfolio ossification. Taxable investment income is calculated based on your net gains or losses, which are derived by subtracting your costs from your earnings. Anything that changes the calculus, then, changes your cost basis and after-tax income. J.P. Morgan conducted an analysis of how annual cash contributions can maintain potential tax savings, as seen below.

IRS Publication 550 governs the offsetting of losses and gains, the $3,000 ordinary income cap, and the wash-sale rules. Wash sales—buying “substantially identical” securities within 30 days—can nullify the tax benefit and apply across accounts, including IRAs. Disallowed losses are generally added to the basis of replacements unless transacted in a retirement account, where the loss is lost.

Technology assists; it does not replace sound judgment or professional advice. Fulcrum’s platform flags risks, automates tracking, and documents every step for transparency and tax reporting season. It even helps avoid wash-sale violations. Final decisions rest on collaboration—between clients, financial advisors, and tax advisors or accountants.

Investing through uncertainty is a challenge. With care, detail, and ongoing attention, market losses in taxable accounts can be put to productive use—building after-tax wealth and keeping clients in control. Systematic tax-loss harvesting on Fulcrum’s platform can help investors reconsider what a loss means to them, their portfolio, or even their retirement.

The possibility of enhancing after-tax returns is certainly a benefit, but more importantly, you can’t put a price on the peace of mind that comes with turning volatility into opportunity. Statistically speaking, investing involves risk, and it’s all but guaranteed for markets to eventually have a down day, so why not make the most of them by reducing your tax burden?

Fulcrum Equity Management, LLC, doing business as Fulcrum Wealth Management Management, is an investment adviser registered with the SEC. Fulcrum Wealth Management only conducts business in jurisdictions where it is properly notice filed, or is exempted from such filing requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability.

Content should not be viewed as personalized investment advice. All investments and strategies have the potential for profit or loss. Index performance does not represent results obtained by Fulcrum Wealth Management and does not reflect the impact that advisory fees and other expenses will have on the returns. There are no assurances that an investor’s portfolio will match or exceed any particular benchmark. Alternative investments are speculative, may be susceptible to fraud, involve a high level of risk, and may experience significant price volatility. You could lose all or a substantial part of your money, and your interest may be illiquid. They may involve complex tax structures and higher fees.