The circumstances serve as a sound lesson in why attempting to time the market is often ill-advised. The early decline in stocks—most notably technology—can be attributed to questions of an AI bubble becoming more common alongside hawkish remarks from the U.S. Federal Reserve. Expectations for interest rate reductions dwindled in response, but swiftly surged to approximately 80% once policymakers indicated they remained a possibility.

Index performance can be seen as an aggregate of investor sentiment, and feelings move fast.

Along a similar vein, the price of gold often shows a tighter link to the prevailing market mood than most commodities, which tend to follow supply‑and‑demand dynamics. Gold’s tendency to respond more to feelings than to fundamentals makes it difficult to forecast with confidence. The same forces that have driven the noble metal higher—geopolitical conflict, concerns over the U.S. dollar’s reliability, and inflation pressures—can shift quickly, so monitoring exposure and managing portfolio drift is critical. Ironically, the tailwinds supporting gold often act as headwinds for other asset classes, which can magnify concentration and volatility risk in a bullion‑heavy strategy.

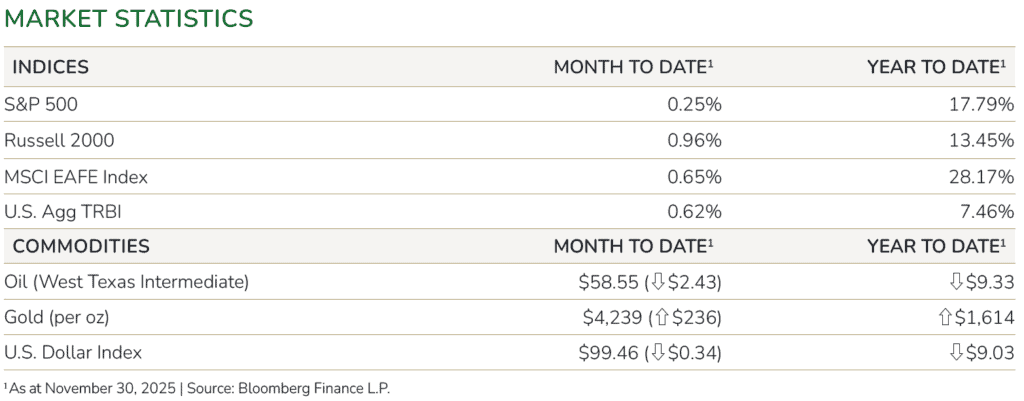

On the other side of the ledger, tariffs, stagnant housing market activity, and slowing employment growth are weighing heavily on U.S. consumers. The economy may require further monetary support, but persistent inflation has complicated matters. The One Big Beautiful Bill Act’s corporate tax provisions, many of which came into force in Q3 of this year and are slated to grow into the next, may provide a potential offset to cost pressures. At the global level, Germany leads the Eurozone’s expanding fiscal capacity after years of underinvestment. Less positive developments are in proximity. Peace talks between Kyiv and Moscow are slow to evolve, Israel-Palestine ceasefire agreements have yet to curb clashes, and the U.S. Navy has stationed off the coast of Venezuela. Record levels of domestic oil production and OPEC+ increases have left the market well-supplied, outweighing geopolitical risk premiums—for now, oil prices remain suppressed.

Chair Powell is nearing the end of his term, and President Trump has clearly indicated that he’d prefer a successor supportive of aggressive interest rate cuts. Following through on those wishes may be short-sighted. If investors perceive the Fed as compromised—prioritizing politics over policy—there’s a possibility of longer-term yields creeping higher.

North American bond markets were relatively flat for the month, and credit spreads sustained low levels. Given the crossroads, we continue to find value in a strategy recognizing several possible inflection points. Inflation-linked bonds provide a stopgap against dollar value erosion, while bank loans could benefit from forecasted growth heading into the new year and high carry rates. In the interim, asset-backed securities offer attractive risk-adjusted yields, which couple well with tax-efficient municipal bonds.

The best views are achieved from great heights, along with a willingness to accept how far one is from safe ground. Technology stocks demonstrated that when expectations are left unchecked, they can lead to concerns; investors now wonder what the path to profitability will be for the hundreds of billions invested in the AI buildout. Such questions introduce vulnerability if gone unanswered for too long.

This is not to suggest that AI investments can’t succeed, but expectations around how quickly they should generate returns have accelerated.

While the S&P 500 certainly has immense promise given its dominant position in technology, it has lagged behind international markets further afield. Retail investors are likely predisposed to what is familiar, but at the institutional level, many are beginning to rotate capital away from the U.S. to manage the risks of established frameworks being reconfigured under the current administration. Lower interest rates could widen the performance gap further between nations and sectors.

While this month’s headlines centered on public markets, some developments help illustrate why alternative investments have a role in portfolios. November’s early sell-off in technology was broad, yet Alphabet (better known as Google) held up better than many peers. That relative resilience did not come from “AI exposure” alone but from differentiated drivers within that theme.

Taking part in market momentum—alternatives or otherwise—requires an understanding of how narrow the underlying story is. When the opportunity set is tight, public investments may command a premium to participate.

Gemini 3’s strong post-launch showing, alongside Google’s proprietary tensor processing units (TPUs) for AI training and inference, gave investors reasons to look beyond a single hardware supplier or software platform. In effect, Alphabet offered multiple paths to participate in the same structural trend. Alternatives are built on a similar principle. Private equity, private credit, infrastructure, and other non‑public strategies seek returns tied to different cash flows, capital structures, and time horizons than the dominant public market names. If the current AI narrative in public equities were to unwind, mature, or simply shift its focus, those alternative sources of risk and return should be more insulated from the immediate ramifications—not because they avoid innovation, but because they are not reliant on one narrow expression of it. Differentiation is the basis for diversification.

Fulcrum Equity Management, LLC, doing business as Fulcrum Wealth Management Management, is an investment adviser registered with the SEC. Fulcrum Wealth Management only conducts business in jurisdictions where it is properly notice filed, or is exempted from such filing requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability.

Content should not be viewed as personalized investment advice. All investments and strategies have the potential for profit or loss. Index performance does not represent results obtained by Fulcrum Wealth Management and does not reflect the impact that advisory fees and other expenses will have on the returns. There are no assurances that an investor’s portfolio will match or exceed any particular benchmark. Alternative investments are speculative, may be susceptible to fraud, involve a high level of risk, and may experience significant price volatility. You could lose all or a substantial part of your money, and your interest may be illiquid. They may involve complex tax structures and higher fees.