Naturally, these positive forces have been well-received. What was less expected was the muted reaction toward the longest U.S. government shutdown in history—although now resolved after a small band of Democratic senators crossed the floor.

The circumstances have made official economic data scarce, but there are indications that the North American economy is slowing. A report from the Chicago Federal Reserve flagged the unemployment rate creeping up, and inflationary pressures persist through tariffs.

After nearly two consecutive years of undeniably impressive returns, equity markets the world over have become more expensive over time as well. We note, however, near-term performance has historically moved independently of high valuations.

Positive investor sentiment is pronounced, and substantial liquidity from softer monetary policy could continue flowing into market opportunities rather than savings vehicles. Both forces have the potential to drive share prices even higher.

Global commerce, which functions best unfettered, is heavily influenced by the U.S. and China’s trade activity. Headlines suggest positive outcomes from recent Trump-Xi meetings—tariffs deescalated, soybean purchases resumed, rare-earth controls loosened—but they may prove temporary. Beijing, for example, has suspended its export regime for one year. Those critical materials are of strategic, defensive, and economic value; they are real leverage. Like the trade agreement with our neighbors to the north and south, we will be closely watching how negotiations proceed with the east.

Key relationships with other nations have been complicated by sweeping tariffs, which the Supreme Court is now weighing whether they can remain intact. On the surface, eliminating them could remove much of the uncertainty that has characterized 2025. We must, however, consider how such a move complicates America’s fiscal challenges. Import tax revenues play an important role in offsetting an aggressive spending and tax cut agenda—if tariffs disappear, funding from elsewhere will be needed to contain sovereign debt. Replacing them with bond issuances may undermine long-term confidence in the U.S. as yields climb.

Contrast is becoming commonplace. Affluent Americans have buoyed consumer spending, but lower-income households are stretched thin. Excluding massive AI infrastructure investments, GDP growth is subdued. A divided Fed highlights the challenge of making policy decisions while being deprived of key economic data sets—Chair Powell’s remarks on the subject have tempered expectations for near-term rate cuts.

“What do you do if you’re driving in the fog? You slow down.”

—JEROME POWELL ON INSUFFICIENT DATA

In this context, strategic selection across duration, quality, and category becomes essential. While the scope of tariff impacts comes into view, inflation-linked bonds can provide near-term protection. Further out, municipal bonds offer attractive after-tax positioning for medium-term allocations. Mortgage-backed securities present an asymmetric opportunity: if Treasury yields decline meaningfully, prepayment risk would emerge in an environment where falling rates signal improving conditions and broader reinvestment opportunities. If housing market paralysis persists, investors continue capturing current spreads. Like we are seeing in the United Kingdom and Germany, there is a risk that fiscal spending and rising debt burdens can put upward pressure on longer-term bond yields.

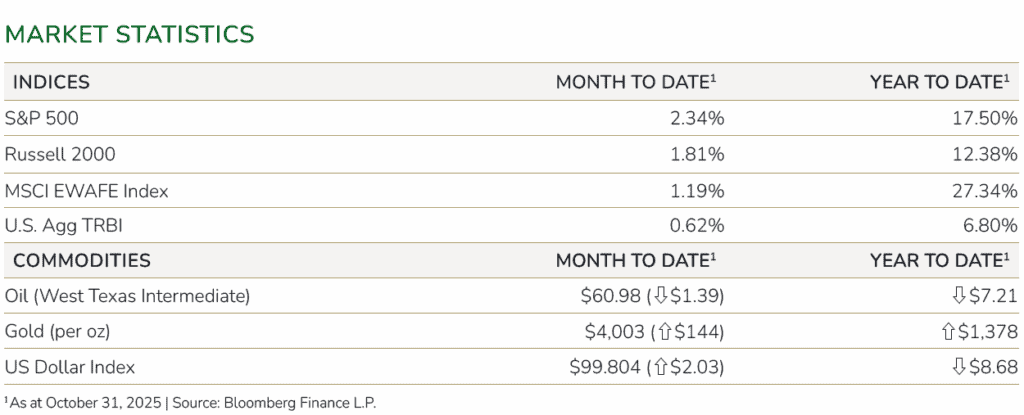

While global stocks have quietly outpaced the S&P 500 year-to-date, the latter pulled ahead in October thanks to the blistering pace of AI infrastructure spending. Investors have given these companies the benefit of the doubt, but Amazon’s recent slide in free cashflow highlights a potential concern. The costs of leading an AI revolution are in the hundreds of billions of dollars—markets, however, are eager to uncover the path to future revenues and profits. In the absence of additional interest rate cuts, investors will likely be even more focused on the pace of corporate earnings growth, drawing further attention to today’s lofty expectations.

We have little doubt of AI’s potential, but we do have two key considerations. First is the distinction between value creation and value capture. Productivity gains clearly demonstrate the former, but some AI leaders have yet to transition from progress to profits. This brings us to our second point. Much of AI’s commercial success will rely on wider corporate adoption, and companies will likely do so if it offers significant cost efficiencies. In other words, while hyperscalers may have the most to gain, the benefits of AI should disperse across other sectors that are far less leveraged to the technology’s success.

AI scalability faces a constraint that no amount of capital can immediately solve: power. Microsoft’s CEO recently revealed the company has GPUs without sufficient electricity to utilize them. The issue is widespread—hyperscalers spent hundreds of billions in 2025’s push, yet deployment lags as regional grids struggle to keep pace.

“The biggest issue we are now having is not a compute glut, but it’s power—it’s sort of the ability to get the builds done fast enough close to power. So, if you can’t do that, you may actually have a bunch of chips sitting in inventory that I can’t plug in. In fact, that is my problem today. It’s not a supply issue of chips; it’s actually the fact that I don’t have warm shells to plug into.”

—SATYA NADELLA, CEO OF MICROSOFT

This scenario reinforces the idea that semiconductor manufacturers are only one element of AI actualization. Private infrastructure investments—notably in power generation, grid upgrades, and data centers—are central to the forces driving markets today. Importantly, energy is fundamental to the everyday world. With allocations toward reliable power generation and transmission capacity, investors can capture tech-driven growth with downside protection from potential AI-spend moderation.

Fulcrum Equity Management, LLC, doing business as Fulcrum Wealth Management Management, is an investment adviser registered with the SEC. Fulcrum Wealth Management only conducts business in jurisdictions where it is properly notice filed, or is exempted from such filing requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability.

Content should not be viewed as personalized investment advice. All investments and strategies have the potential for profit or loss. Index performance does not represent results obtained by Fulcrum Wealth Management and does not reflect the impact that advisory fees and other expenses will have on the returns. There are no assurances that an investor’s portfolio will match or exceed any particular benchmark. Alternative investments are speculative, may be susceptible to fraud, involve a high level of risk, and may experience significant price volatility. You could lose all or a substantial part of your money, and your interest may be illiquid. They may involve complex tax structures and higher fees.